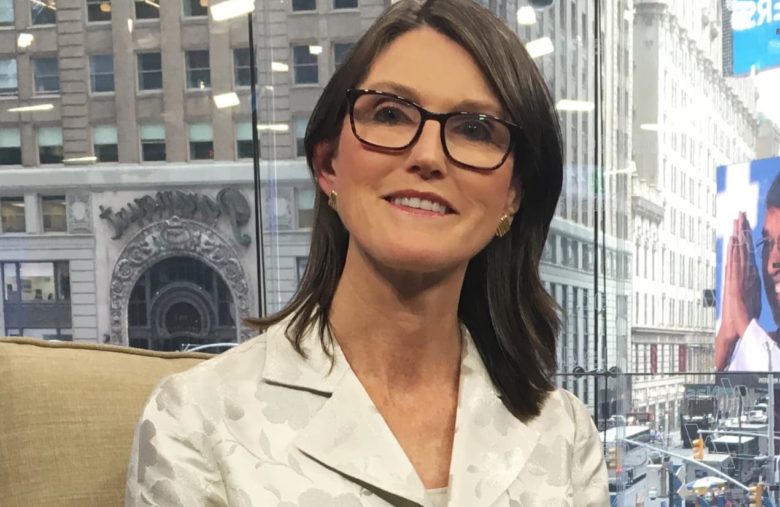

Founder and CEO of Ark Investments Cathie woods net worth

Let’s bypass the boring stuff and get talking about what is important to most of the readers here?

The ongoing dip circumstance is taking the crypto space by storm right now.

Let’s start by taking a look at the charts of the bitcoin and the correction it is facing. If you are following and are even invested in the crypto space even for a bit right now then this correction must be a little worrying for you. Except for a few tokens/coins the whole crypto space is facing a huge correction, this is such a huge correction that it last happened in the 2017 crash.

Let’s pull out the 2017 chart for bitcoin and you will notice a really funny thing that this correction is exactly a lookalike of the 2017 crash and what happened next?

Bitcoin jumped almost 300% taking out all the resistance and hitting some new all-time highs.

Why are we calling this a correction and not a crash?

The answer is simple because it has happened before and the first time we named it a crash as we were not certain that it will bounce back or not but, now we are somewhat certain that the cryptocurrency market will not crash for the second time giving out the same patterns, hence we are calling this a healthy correction and looking forward to seeing a huge bounce back as much bigger institutions are on board with us.

Now, let’s look at the reasons why this can be a healthy correction and what is buy the dip philosophy?

If we look at the bigger picture then it is evident this is a new dip for the whole world after the 2017 crash and what happens at the dip, new investors come in and buy it as they speculate some amazing returns in the near term or even at longer terms.

Even, I will take this article as an opportunity to tell our readers that I bought the dip too and I am also speculating some amazing returns. The one who holds will win in the longer term, also I will not recommend anyone to trade in cryptocurrency right now, as the market is hugely volatile for the shorter term, let space settle down a bit.

If this didn’t calm you down, then let me tell you about one personality who is speculating for the bitcoin to reach $500000 in the longer term and why you should believe her because when Tesla was going through a dip like this she was the one who speculated Tesla to reach a certain valuation and Tesla did that two years prior to her speculated target even when it sounded ridiculous to others. So, one who is able to hold should never sell and wait for the speculations to come true.

Let’s get to know more about Cathie Wood, the founder, and CEO of Ark investments, and the huge networth she holds.

Also Read : Bill Miller Net Worth

Introduction

Cathie woods was born in Los Angeles, California, United State. She completed her formal education at the University of Southern California earning a degree of bachelor’s of Science in Economics and Finance which ultimately defined her career, unlike others.

Presently she is the founder and CEO of Ark investment management, which is a thematic investment firm and invests in themed portfolios and also managing the portfolios of some bigger names of America and the world.

It all started in the year 1977 when Woods joined the capital group as an assistant economist helping in decision making soon, after completing the education she moved on to the position of MD of Jennison associates in the year 1981 serving as the Portfolio Manager and Chief economist of the company.

In 1998, she joined Tupelo Capital services as one of the limited partners and hedge fund manager through which she started her ever-learning journey of Macro strategies and thematic investments. After working for more than 15 years in the same field Woods laid the foundation of Ark investment management in which she focused on thematic investments and portfolio manager as she believes that thematic investment can deliver a better return than any broader investment strategy.

She is known for her Tesla investments as when Tesla crashed for almost 11% she doubled her stake when almost 80% of the analysts were bearish over the company and when it crashed even further she again doubled her stake in the company leading to huge returns when the company grew almost 26% creating a name for her firm. She mentions in her Twitter bio that she believes this validates disruptive innovation as a component of any investment portfolio.

Cathie woods also predicted that bitcoin reaching $500000 is inevitable even after this recent correction and is still bullish on the cryptocurrency market reaching heights.

We don’t have any information regarding her amount of bitcoin investment but, all we know is she believes in thematic investments and constantly is in talks about the crypto space and the crypto space is one of the greatest thematic investments if not for now, but definitely for the future.

Cathie woods Net Worth

One needs to understand the bigger picture to understand the present correction. The total reported net worth of Cathie woods is around 300 million US dollars and if she is bullish about the crypto space then you should also be. I will recommend not to listen to the worldwide media outlets, news streams etcetera and hold on to your holdings until or unless you need those funds immediately. Just HODL.

1 Comment